Real Estate Investing

Ask The Experts: Let’s Talk Rising Interest Rates & The Housing Market

Last Updated Jun 30, 2022

You asked, we answered. Homeowners have told us the biggest concern on their minds at the moment is rising interest rates and its impact on the American housing market. So in June, Belong launched its first webinar conversation (not financial advice as the classic disclaimer would say!) with experts in real estate to address your burning questions. For anyone who missed it, you can catch up on the recording here or check out the article below for the highlights.

Our experts:

Jon Martin, JDM Asset Management

Jon is a career Asset Manager, based in Los Angeles, who has managed well over a billion dollars in real estate assets on behalf of institutional clients. Partnering with Belong, he has shifted his focus to supporting smaller scale real estate investors in this wild financial climate.

Celeste, Marketplace at Belong

Celeste works closely with the product team and consultants such as Jon to adapt financial planning and asset management approaches for the everyday rental property investor. She partners 1:1 with Belong Homeowners to help navigate strategic decisions to optimize their investments. Previously, Celeste was a Partner at the Boston Consulting Group in the Bay Area.

Are the recent interest rate rises the end of “cheap debt”?

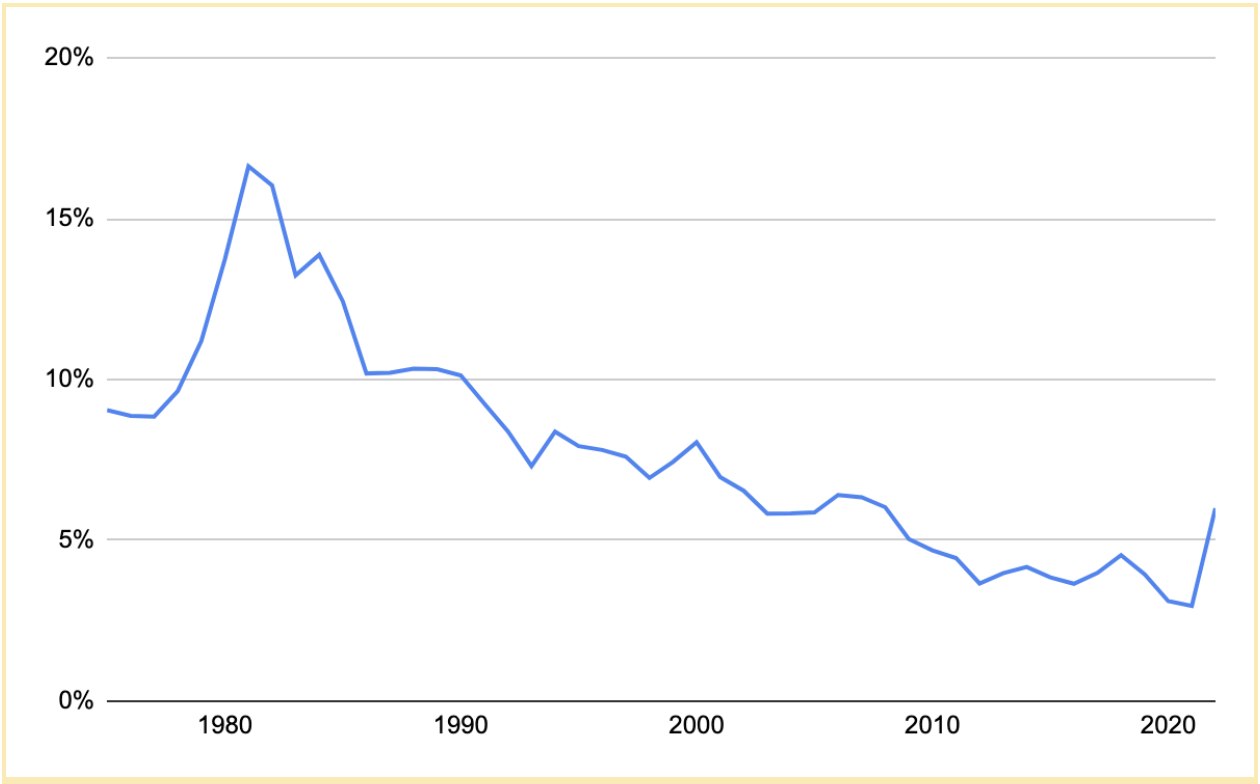

Interest rates have risen sharply in 2022 after more than a decade of historic lows coming out of the Great Recession. In 2020 and 2021, the 30-year mortgage rate had fallen below 3%. Yet by the end of May 2022, mortgage rates had doubled, reaching well over 5% for the 30-year fixed — coming as a big shock to many who don’t remember the sky-high rates of the 80s.

“It’s worth grounding ourselves in the fact that historically speaking, rates are still low,” says Celeste.

“100%,” agrees Jon. “...we’ve gotten very used to cheap debt. But in the 80s, rates briefly spiked over 15% — also when the Fed was battling record inflation. Even more recently than that, rates before the Great Recession were 5-6%, like what we’re seeing already this summer,” explains Jon. “Rates have just come down and down for 20 years now, which has fueled a rise in asset prices and tremendous equity gains for a generation of Americans who have had money in real estate along this journey”, he adds.

Chart: Interest rates over the past few decades

So what next? With inflation still accelerating and not plateauing, there’s likely to be more rises on the horizon for July and beyond.

“That being said, everyone is expecting more meaty rate hikes from the Fed at this point – this expectation has already been priced into the mortgage rates we’re seeing,” explains Celeste. “The reason we saw this sharper acceleration in June was because May numbers were worse than expected. Everything in economics is relative to expectations,” she says.

“The Fed is obviously hell-bent on taking the steam out of pricing pressure. They’re looking to bring inflation back to the 2% steady state range. The next big indicator to watch is the June inflation data, which will be released mid-July. If high inflation persists, there will be more rises to come,” says Celeste.

Will we see interest rates as dramatic as the 80’s and 90’s?

Jon doesn’t seem to think so. “As Celeste mentioned, expectations for further hikes through the rest of 2022 are already cautiously priced in, so it’s unlikely…but rates won’t taper off until inflation does. So certainly don’t expect to see 3-4% mortgage rates again anytime soon,” he says.

What does the current inflation rate mean for the housing market in 2022?

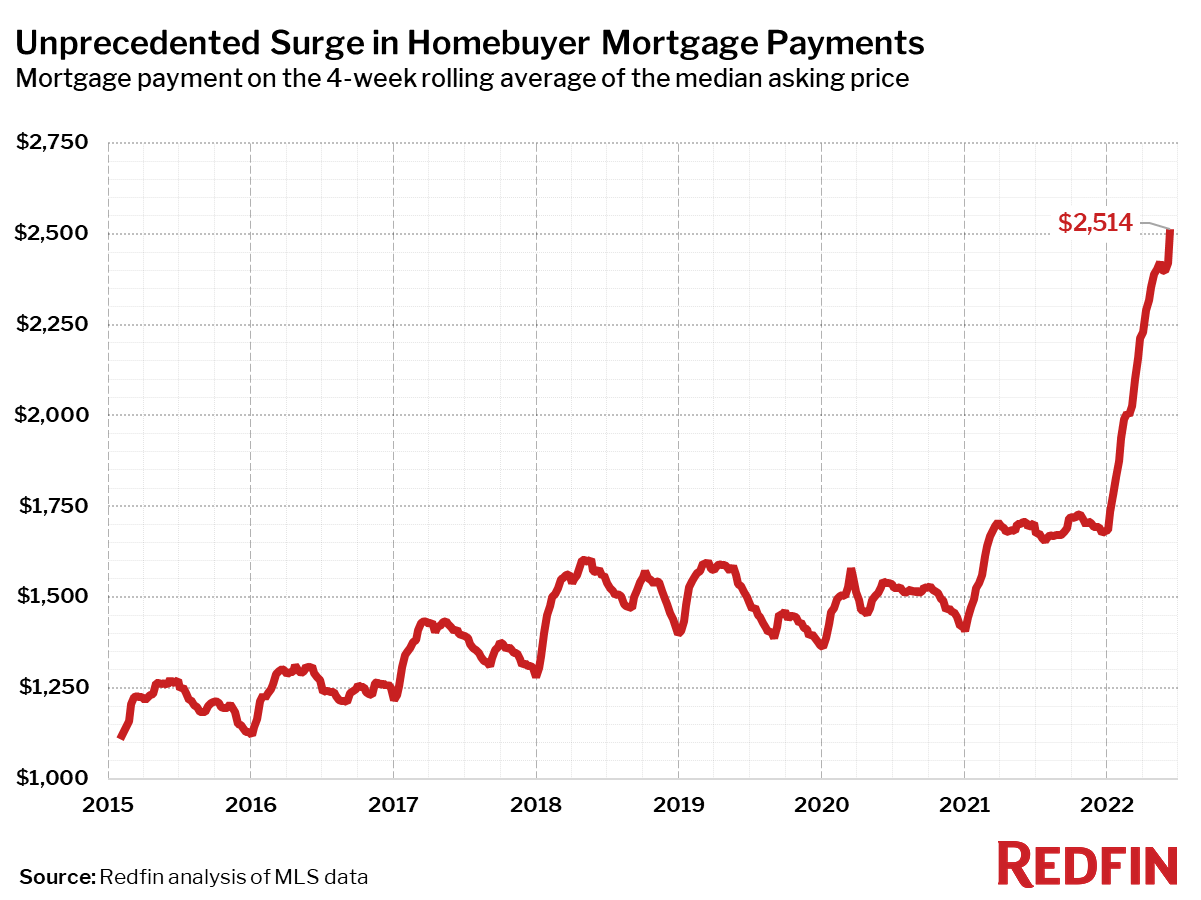

Jon says that on the simplest level, rising interest rates make home purchases more expensive, which reduces consumer buying power. This shrinks demand and pulls down prices. He provided this example:

For a $750k home purchase, with 20% down

- At 3% interest = ~$2500 per month

- At 6% interest = ~$3600 per month (Over 40% more expensive!)

“You can potentially refinance later on, but on a monthly basis, those sort of 30-50%+ shocks are just not feasible for pretty much anyone,” explains Jon.

“It’s paralyzing to potential buyers, and when you layer this on top of the asset price increases we’ve seen over the past year, buying a house this summer could be 60%+ more per month than buying that same house last summer. And that pressures people to trade down what they’re buying, or in many cases, bow out of the housing market entirely,” says Jon.

Data from Redfin (pictured below) shows the staggering leap on the cost of a mortgage payment on a medium home in 2022.

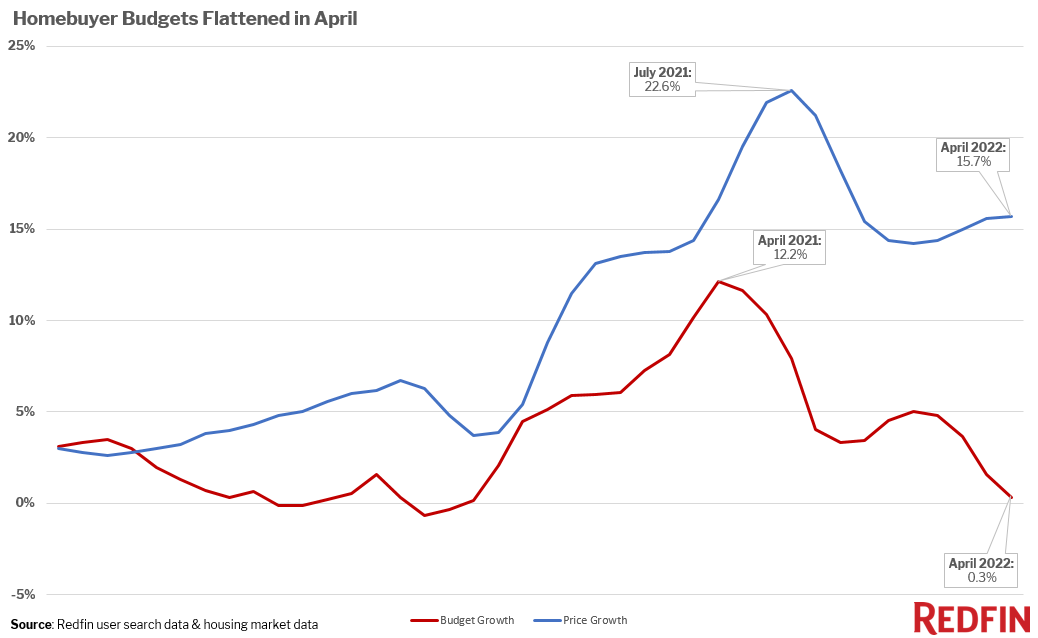

The next graph (also from Redfin) shows that the asset prices had already started to diverge from buyer budgets before the rate hikes. This is based on what buyers are searching for on Redfin. “As people qualify for smaller mortgages, you can expect this pattern to continue,” says Celeste.

Jon says “Right now economists are pretty mixed about how this will all net out for housing prices – that’s the big question. Few believe that a significant crash is on the horizon, but it’s hard to believe a meaningful cool-down isn’t finally seeping in.”

Celeste agrees, “Yes. No one's expecting this to be like 2008 – the market looks meaningfully different. The supply/demand balance looks different, homeowners have more equity built up in their homes, and lower debt service ratios than we’ve had in decades. So we don’t have anywhere near the structural fragility we had 15 years ago,” she says.

“Exactly. But we’re still early here. Where we’re definitely seeing the impact already is on the volume of listings & sales. After years of record-low supply, the number of listings has been growing over the Spring and into Summer. And by this month, the total number of listings on market is up 15%+ over last year,” adds Jon. “So you see that we’re starting to accumulate some excess supply relative to tightening demand. You have some skittish homeowners that are trying to take advantage of still-high prices, but a gap is starting to emerge between seller expectations and what buyers are able to pay. So consequently, we’ve seen home sales fall for each of the last 6 months. Mortgage applications are down over 15% since last year, and of course, refinancing has basically gone to zero,” says Jon.

“It makes sense that many folks are retreating to the sidelines to wait this out,” says Celeste. “Jerome Powell basically gave that advice explicitly in his latest press conference, to young folks in particular. There was a great New York Times article essentially saying just this. As interest rates spike, we can expect folks to simply stay put, or even be “underhoused” – to live in less house than they perhaps need or want. In this rate environment, it can make more sense to renovate or expand, rather than move – but whatever you do, don’t give up a low, fixed mortgage.”

What does this mean for the rental market specifically?

Since all of the Belong homeowners hold rental properties, Celeste and Jon discuss what this means for the rental market.

Jon notes that what is tough news for many Americans grappling with inflation, is actually positive for rental property owners, with the hot rental market likely to intensify further.

“At higher interest rates, fewer prospective homebuyers will qualify for mortgages (or at a lesser dollar amount) and will instead choose to keep renting. Rising rental demand will further push rents up – we’re actually already seeing that, with median nationwide rent passing $2,000 for the first time ever in May,” explains Jon.

“From the Homeowners perspective, with lower and typically fixed rate mortgages already locked in, and rents likely to continue rising, yields will improve. It’s a fantastic time to be sitting on rental property,” he notes.

Is now a good time to be acquiring a rental property?

One final Q&A from our webinar audience was for those who are thinking about acquiring rental property. Is now a good time or should prospective investors hold off?

Jon says now is a good time to keep a watchful eye for opportunities. “After so many years of intense competition, there’s honestly some welcome relief here – with cooling demand and fewer bidding wars, coupled with rising rents, we should see some cap rate expansion in the near future, meaning pricing coming down,” he says.

“The question comes down to what your overall hurdle rate is given the current market conditions. So while you’ll have to factor in a higher cost of capital when analyzing your next opportunity, the recent upward pressures on rents and the likelihood of locating an attractive single family rental through less competition, and hopefully better pricing are creating a more attractive market for acquisitions.”

“Another point to consider when looking to acquire a rental, for those sitting on cash, is a higher down payment than say the standard 20% to reduce your exposure to higher interest rates. This will only help when running the numbers to see if your rental income will cover your operating expenses and mortgage payments,” he adds.

“And finally, and this may just serve as a reminder to most of you, are the tax advantages of holding rental property – having the ability to depreciate the physical structure of the home and the cost of any property improvements; along with deducting most expenses related to operating a rental. So all in all, the picture can still look quite good for acquisitions,” says Jon.

Got more questions for Belong? Contact us 24/7

Whether you prefer email, online chat or a good ol’ fashioned phone call, we’re here to answer any questions you may have. Contact us or learn more about becoming a Belong homeowner here.